income tax rate philippines 2021

Philippines Residents Income Tax Tables in 2022. Income Tax Rates and Thresholds Annual Tax Rate.

The Impact Of The Philippine Tax Reform On Startups

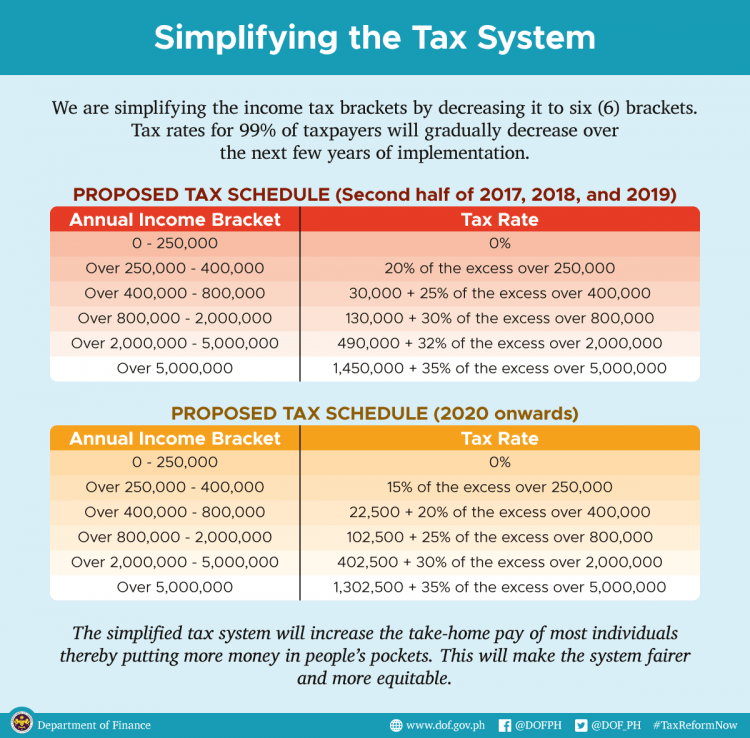

Up to PHP 250000 0 PHP 250001 PHP 400000 20.

. Philippines Residents Income Tax Tables in 2023. 11534 Corporate Recovery and Tax Incentives for Enterprises. The compensation income tax system in The Philippines is a progressive tax system.

The Superfund Excise Tax went into effect on July 1 2022 and many companies are still struggling to understand how it appliesWith the. Philippines Residents Income Tax Tables in 2022. The RMC clarifies BIR Revenue Regulations RR 5-2021.

Social taxes consist of contributions to the Social Security System. Income Tax Rates and Thresholds Annual Tax Rate. 2021 Alternative Minimum Tax Exemption s.

The maximum annual social tax payable by a foreign national employee is PHP 32700 for tax year 2022. Under the Corporate Recovery and Tax Incentives for Enterprises. 8 Income Tax on Gross SalesReceipts and Other Non-Operating Income in Lieu of the Graduated Income Tax Rates and the Percentage Tax.

Individual income tax rate Taxable income Rate. Compliance for corporations. Income Tax Based on Graduated.

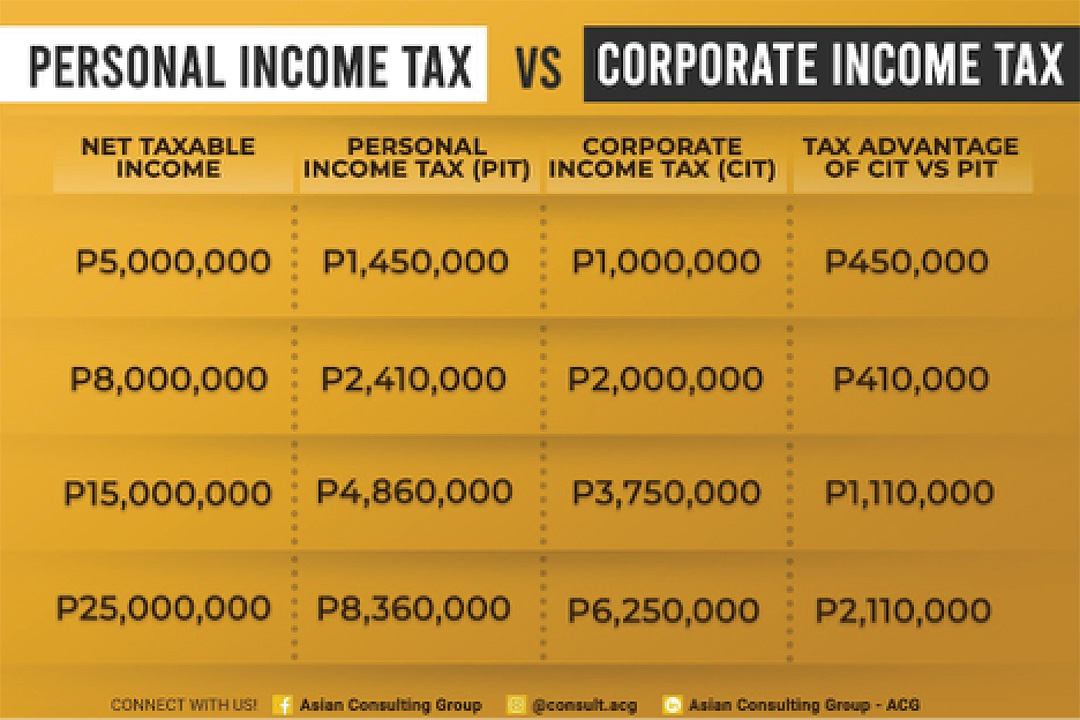

Which corporate income tax rate should be used. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates. This largely resulted with the implementation.

Personal Income Tax Rate in Philippines averaged 3253 percent from 2004 until 2020 reaching an all time high of 35. Income Tax Rates and Thresholds Annual Tax Rate. Philippines Highlights 2021.

Implements the provisions on Value-Added Tax VAT and Percentage Tax under RA No. 8 tax on gross salesreceipts and other non-operating income in excess of PHP 250000 in lieu of the graduated income tax rates and percentage tax business tax or. The latest comprehensive information for - Philippines Personal Income Tax Rate - including latest news historical data table charts and more.

The Philippines applies a tax arbitrage rule on deductible interest that reduces the allowable deduction for interest expenses by 20 of the interest income subject to final tax. The Philippine President signed into law the proposed Corporate Recovery and Tax Incentives for Enterprises CREATE Act on 26 March 2021 1 but vetoed several provisions. The Personal Income Tax Rate in Philippines stands at 35 percent.

Libya Personal Income Tax Rate 2022 Data 2023 Forecast 2009 2021 Historical

New Income Tax Table 2021 Philippines Tax Table Income Tax Income

Income Tax Law Under Train Law And New Rates In The Philippines

New Income Tax Table 2022 In The Philippines

Japan Personal Income Tax Rate 2022 Data 2023 Forecast 2004 2021 Historical

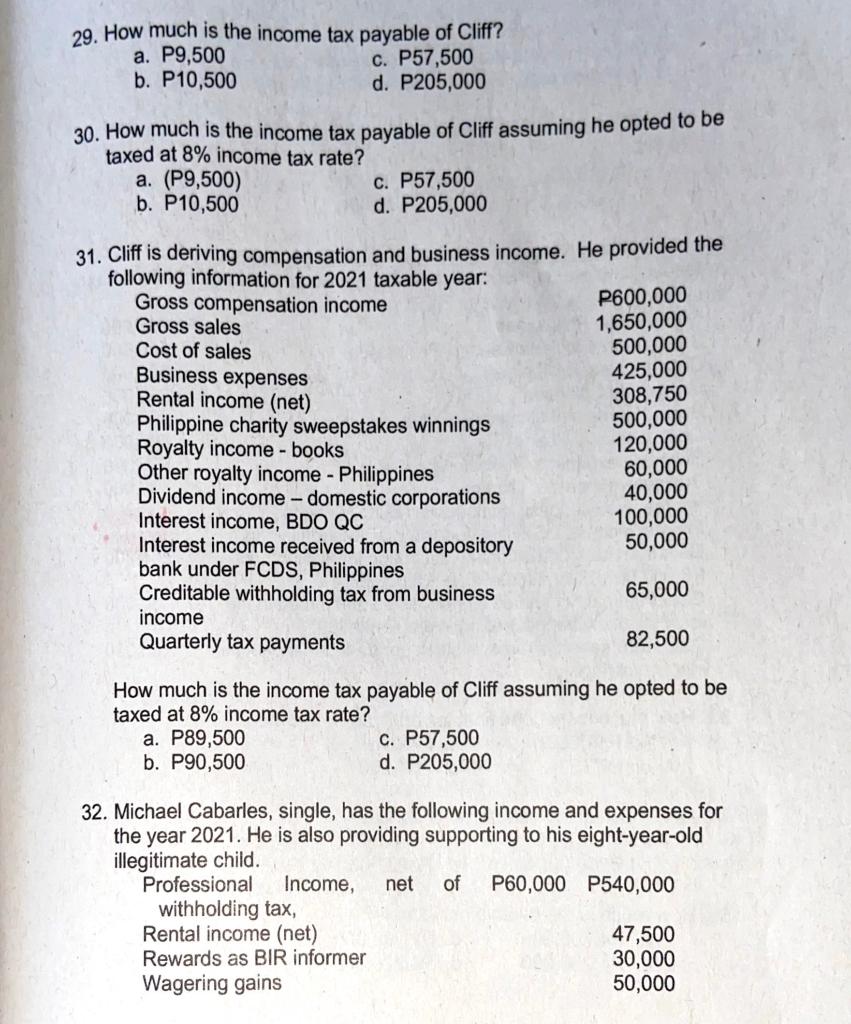

Solved Use The Following Data For The Next Two 2 Questions Chegg Com

What Is The Difference Between The Statutory And Effective Tax Rate

Philippines To Cut Corporate Tax To 25 To Aid Recovery From Covid Nikkei Asia

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

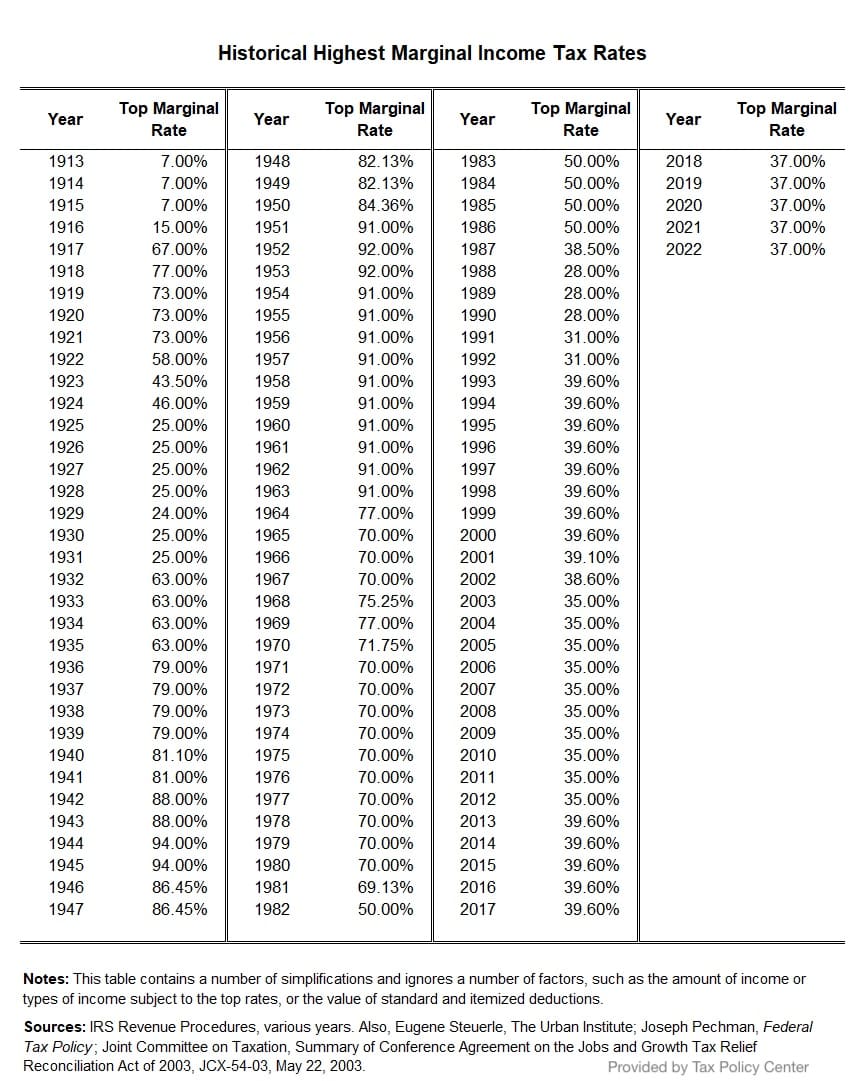

Income Tax History Tax Code And Definitions United States

What Is The Difference Between Marginal And Average Tax Rates Tax Policy Center

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

Solved E Corporate Income Tax Problem Solving Phonie Raria Corporation A Philippine Corporation Has The Following Financial Information For The Cur Course Hero

Income Tax Law Under Train Law And New Rates In The Philippines

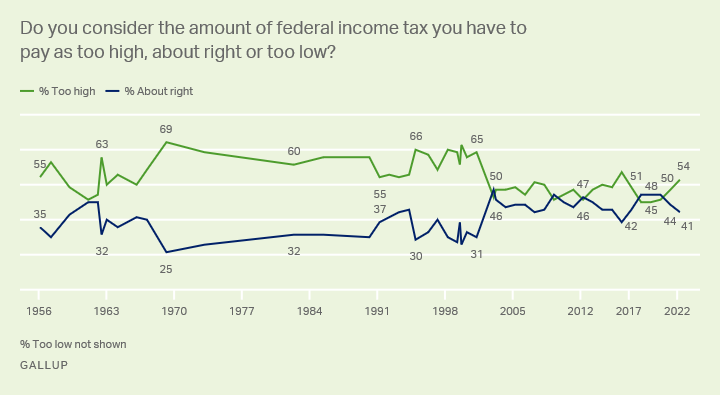

Taxes Gallup Historical Trends

Tax Reform In Progress Businessworld Online

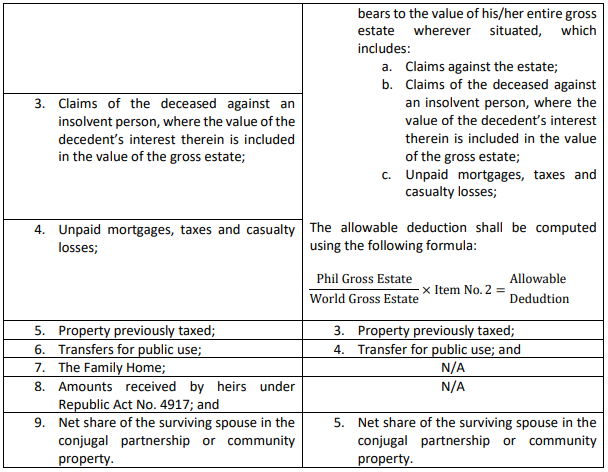

The Unspoken Cost Of Dying A Summary Of Philippine Taxes After Life Lexology